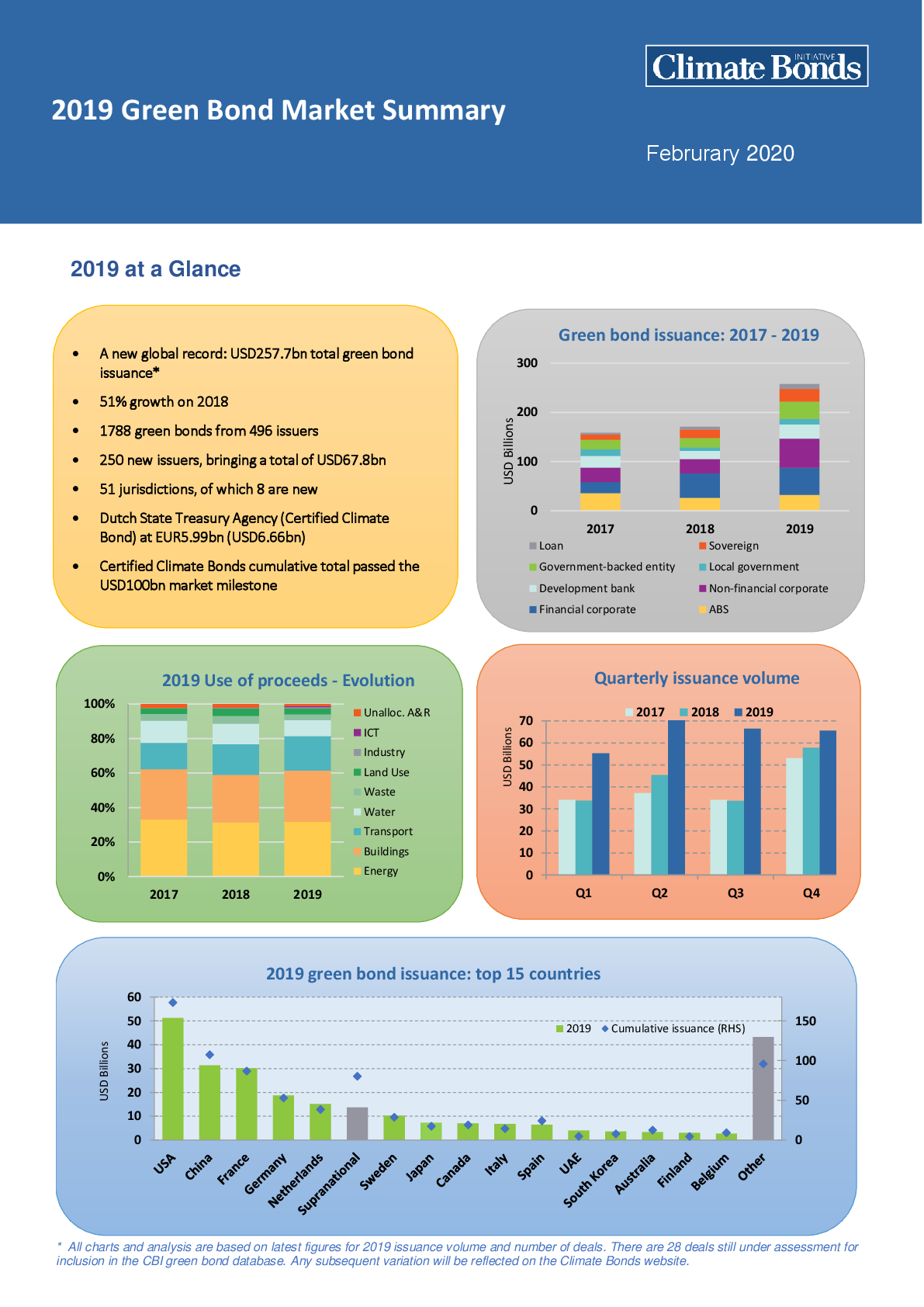

2019 Green Bond Market Summary

Global green bond and green loan issuance reached an adjusted USD257.7bn in 2019, marking a new global record. The total is up by 51% on the final 2018 figure of USD170.6bn. Of the total, USD10bn (4%) are green loans.

The 2019 volume was primarily driven by the wider European market, which accounted for 45% of global issuance.

Asia-Pacific and North American markets followed at 25% and 23%, respectively.

In 2019, the total amount of green bonds issued in Europe increased by 74% (or USD49.5bn) year-on-year, reaching a total of USD116.7bn.

Report Highlights

• A new global record: USD257.7bn total green bond issuance*

• 51% growth on 2018 annual figure

• 1788 green bonds from 496 issuers

• 250 new issuers, contributing USD67.8bn to the annual total

• 51 jurisdictions, of which 8 are new

• Green loans at 4% & growing

• Single largest green bond via Dutch State Treasury Agency (DSTA) Climate Bonds Certified at EUR5.99bn (USD6.66bn)

• Climate Bonds Certifications pass the cumulative USD100bn milestone